Core Banking Solutions

1.1.Finacle Core Banking System

Building Tomorrow’s Bank

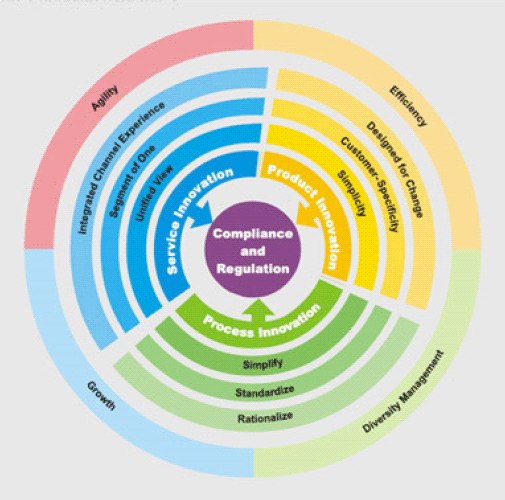

Managing costs effectively can only take your business so far. What your bank really needs is accelerated growth. Whether it’s entering new markets, introducing innovative new products, or initiating transformational process changes, you need to aggressively unlock the key value levers of your business. Very powerful waves of change are creating new opportunities. The advent of the digital consumer, new commerce changing the rules of the game, and the emergence of the Cloud are some significant examples. We believe that accelerating innovation will enable banks like yours, to withstand further tremors, counter market forces, spark growth and create competitive advantage. However, one must be careful to invest energies in meaningful innovation, which contributes to agility, efficiency, growth, and value creation for both the organization, customers and partners. Product, service or process innovation initiatives must be aligned with the new reality defined by higher customer expectations, tighter resources, fiercer competition and stricter regulation.

Although banks innovate from time to time, most do not have a cohesive innovation strategy in place. That needs to change, and quickly. While laying down the vision for innovation, senior management must ensure ground-level support by way of technology infrastructure, employee training and a collaborative partner network. This is the proven path to accelerate innovation and build tomorrow’s bank.

Tomorrow’s World: Changing Dynamics

Future of banking institutions depends on how successfully they meet the following expectations:

- Managing Consumer-driven Sales

- Complying with Emerging Regulations

- Tackling Competition

- Coping with Organizational Restructuring

- Regaining Consumer Confidence

- Managing Green Regulations

- Staying Abreast with Changing Technologies

- Adopting Cross-industry Best Practices